Tags

Buying a Home, Discount Interest Rate, Finance, First Time Home Buyers, Interest Rate, Interest Rate Differential, Mortgage Choices, Mortgage Professional, Mortgage Rates, Mortgages, Renewal, Why use a Mortgage Broker

If you had to break a contract for the same product which would you prefer to pay — $3,375.00 or $15,375.00? So why are people paying the higher amount?

Statistics show 70% of people who sign a mortgage contract sign a five year fixed rate mortgage contract.

Of these 70% that sign a five year fixed mortgage contract, 58% break them on average after year 3. Wow –58% — that is a lot of people breaking their mortgage contract!

Reason why? It was an unexpected event. Most thought they would be in their home for 5 years but then came the unexpected — job change, marriage, move, renovations, or the other umpteen possibilities

Let’s take the story of Jennifer and Cindy who are each homeowners, and quite content in their homes. Jennifer and Cindy work in a company that has recently decided to expand and will be moving their positions to a different city and province. They each have decided to sell in order to buy a home in their new location. When Jennifer breaks her mortgage to sell she pays a penalty of $3,375.00 and Cindy pays $15,375.00

Why does Cindy pay more and a lot more? All the variables are the same for each of their mortgages —except for one– their choice of lender. Let’s take a look at what is happening.

The mortgage details are the same for both and they are:

- 5 year fixed rate of 2.69%

- 2 years left on their mortgage

- 2 year fixed rate of 2.24%

- Outstanding amount on their mortgage $375,000.00

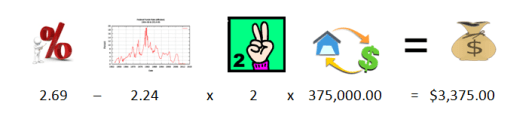

When Jennifer breaks her mortgage, the formula that is used for a fixed rate mortgage is IRD which stands for Interest Rate Differential. Jennifer’s Lender calculates her IRD as such:

Formula:

Her current rate – current rate on 2 years x time left on mortgage x outstanding amount = IRD)

Cindy’s Lender adds something called a discount and this was the discount she received on her interest rate from her lender at the time she signed her mortgage. A posted rate on lenders web sites are often higher than the rate they offer you but some of them have quite a large spread between the posted rate and the rate that they gave you. This posted rate minus the rate they gave you is their discount to you and this discount has a big impact on the breakage cost. 4.59% was the posted rate and the discount Cindy received was 1.60%. Check it out……..

Formula:

Current rate – (current 2 yr. rate – discount) x time left on mortgage x outstanding amount =IRD

The red house representing the discount received – yikes!! What a difference that does make.

Buyer beware — ask your lender how your penalty is calculated or speak with a Mortgage Broker for more details on your options.

“O.A.C.E. & O.E.” Rates & Stories for illustration purposes. Marg DeBoer